There was bright news for the service sector in April as it saw another increase in activity for the 16th month in a row.

Traditionally the service sector has not been a bell weather for the health of the UK economy, but is recent years, as the sector has grown in influence it is now exactly that.

Where the service sector points, the economy is seen to follow. Against this backdrop therefore another month of increased activity suggests the potential for another strong quarter for economic growth.

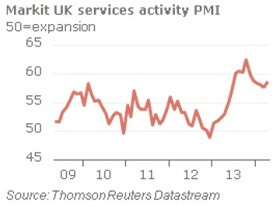

The Markit/CIPS service PMI rates service sector growth as an index where a score of 50 or more indicates a growth in the sector.

For April the score was 58.7, well into growth territory.

The good news however isn’t only confined to services, as combined with the construction and manufacturing PMIs and their respectively buoyant plans for recruitment activity, the UK economy is heading for Q2 2014 growth of 0.8% or more, that is according to Chief Economist at Markit, Chris Williamson.

“Such a rate of growth in the second quarter would lift gross domestic product above its pre-recession peak, extending further the strongest spell of economic growth that the country has seen since the financial crisis struck”

However, as ever, a note of caution was sounded about potential over heating given the fine balances on which economic decisions are made.

Alan Clarke of Scotiabank warned that the combination of deep recovery across the sectors and a buoyant employment and housing market meant a Bank of England rate rise wasn’t too far way.

Clarke said in rhetorical fashion:

“If you can’t hike [interest rates] with double-digit house price inflation, a near-60 PMI reading and strong labour data, when can you?”

Regardless, we’ll take the good news about buoyant sectors positively and deal with the potential rate rise later. For now it is extremely encouraging to hear and feel the recovery is beginning to reach all parts of the economy and not just the few.