Brent crude might have plummeted between June 2014 and January 2015 but unfortunately this has a limited impact on the price of gas and even less on the price of electricity.

Brent crude might have plummeted between June 2014 and January 2015 but unfortunately this has a limited impact on the price of gas and even less on the price of electricity.

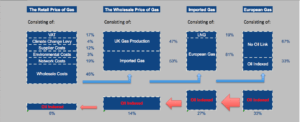

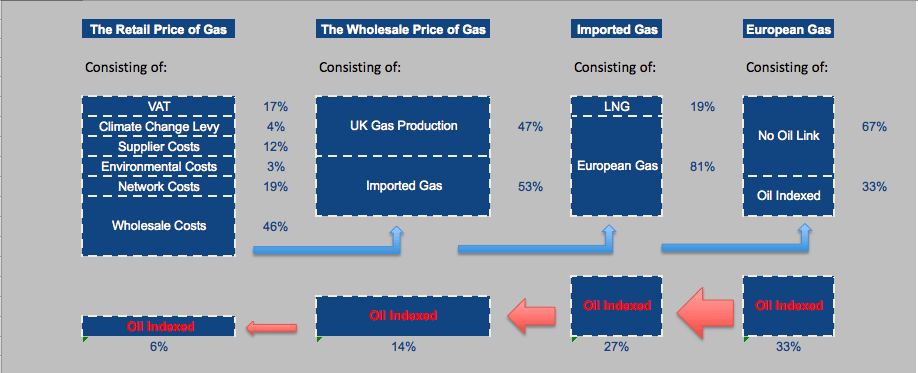

As a nation we import 53% of gas into the UK and of that 73% is from Europe with the remainder being LNG from Qatar.

Traditionally European gas was indexed to the oil price hence the popular misconception that a fall in the oil price will lead to falls in the gas price. This however is no longer the case and in the contemporary market only one third of European gas contracts are indexed to oil.

The result of this means that of the gas consumed in the UK only around 14% has a direct link to the oil price.

This will affect the gas and electricity retail price, the price businesses pay, but in very limited amounts.

Wholesale gas makes up around 46% of the overall retail price, and so only around 6% of the price you pay for gas is in anyway influenced by the falling oil price, a relative fall of 10% will therefore shave 0.4% of your retail price.

To put this in context gas prices fell by 20% between October 2014 and January 2015 due to weak demand and a mild winter (to this point). For electricity the impact is even lower with natural gas only being used in the generation of 26% of electricity and so we can assume that any impact will roughly be 1/4 of that on the gas price.

This however is the best case scenario as the falls in the wholesale price are rarely seen reflected in the retail price, this is because

a) the hedging strategies of suppliers in that they are not necessarily buying the energy in the contemporary wholesale market and may have secured their energy, or a proportion of it, at a historic higher price and

b) the cost of the energy is the minority element of the retail energy price and as a result any market change is muted by the level of taxation and network costs levied.

Visit the following of our 80+ free guides to find out more:

What makes up the price of electricity

What makes up the price of gas

* Just 6% of the overall retail gas price is linked to the cost of oil

* The link is not absolute so a 10% fall in the price of oil will not result in a corresponding 10% fall in the oil indexed element of the retail gas price

* In addition any impact on the indexed element of the retail gas price takes 2-6 months to filter through

* The volume of gas available and the weather forecast have far greater influence on the retail gas price

* Since Jun-14 the oil price has fallen from $115 to $48 a decrease of 58%

* If this entire fall was passed through to the oil indexed element of the retail gas price (it would not be) then the price would have fallen by 4%

* In contrast, since Oct-14 the gas price has fallen by 20% driven by weather and surplus supply

* Oil, and the oil price, contrary to popular belief, therefore has an extremely limited impact on the retail price of gas

In fact in truth the retail price is far less influenced even by significant falls in the wholesale price than was historically the case.

This is because of the growing impact of social & environmental costs (taxes on energy to you and I) and the rising costs of network upkeep and renewal. In April 2015 alone two new taxes will hit the cost of energy and these new cost elements, contracts for difference and the doubling of the carbon floor price, contribute to artificially keeping the cost of energy high even whilst markets fall.

Finally we have to consider the weather forecast: unseasonably mild temperatures dampen demand for gas and at a time of over supply prices fall. This however can reverse very quickly with a cold snap instantly driving prices upwards as fears of higher demand place pressure on price.

Traders trade on sentiment and in doing so a change in the ‘norm’ or even an expectation of a change will always have an impact on price. These days however that influence on the retail price has diminished, to put it another way, even if the gas was completely free, it would still cost 54% of it’s current price to deliver.

That is something our political leaders don’t want us to know, especially in an election year, so the next time Miliband, Osborne or Davey claim they are going to force ‘suppliers’ to pass through the drop in wholesale prices afford yourself a wry smile, it’s simply the worst type of misleading posturing possible.

As a result, as you can understand, we strongly recommend locking in now before the new taxes and inevitable price rebound hits.