Q: If the wholesale price is falling why isn’t my energy bill?

Q: If the wholesale price is falling why isn’t my energy bill?

A: The government

Much has been made recently of the seemingly inexorable falls in the wholesale energy market, look a little closer though and you can see the ‘falls’ are not linear, rather they are a series of peaks and troughs albeit on a long term decline.

As a result it is reasonable to expect those falls to filter through to our energy bills.

That isn’t happening however, but why?

Are the energy companies nasty, greedy enterprises counting their bullion in gated havens?

Or is there a simpler, more balanced reason?

Hedging

Firstly there is the largely opaque, but undeniably influential concept of hedging.

Hedging is whereby an entity (in this instance an energy supplier) ‘hedges their bets’ on where the wholesale market is going and in doing so purchases chunks of energy well in advance of delivery.

Doing this means that the energy is bought (and charged on) at a known price and customers are shielded from the biggest price shocks.

That said this methodology will also insulate customers from price falls, as the energy has already been purchased and needs to be sold at the price originally expected.

Over time of course, if the market is depressed for long enough then the lower prices will filter through into the ‘hedged’ positions of the suppliers and will then be passed on to consumers but this takes a long time and is entirely unique to each individual suppliers’ hedging strategy.

Third Party Charges

BUT there is a flaw in this explanation as the sole reason for falls in the wholesale market not being passed through to consumers.

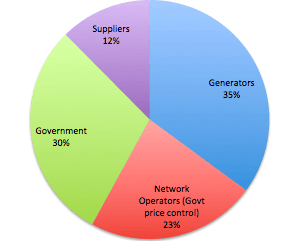

That being that the wholesale cost of energy makes up just 35% of the retail price of electricity (including VAT).

That astonishing realisation has a parallel in another market: Petrol.

In the petrol market some 70% of the total cost is fuel duty that makes its way to the government.

In the electricity market, that level is somewhat lower, but it is still very significant.

Of the 65% of the cost of electricity that doesn’t go on the energy itself fully 30% goes to the government whilst a further 23% goes to the network operators who just happened to have their ‘pricing regimes‘ managed by the government through Ofgem, the energy regulator.

So it could be concluded that the government is directly or indirectly responsible for up to 53% of the cost of energy.

In contrast, the much maligned suppliers, could be responsible for just 12%.

Dominance and growth

Over time, the government’s ‘influence’ over the energy price has seen an inexorable growth more than equal to any long term decreases in the wholesale costs in the energy market.

Put simply, forget hedging, indeed forget falling wholesale energy costs, the reason that energy bills remain high is that the level of ‘third party charges’ as those under the domain of the government are euphemistically known are increasing both in volume and magnitude.

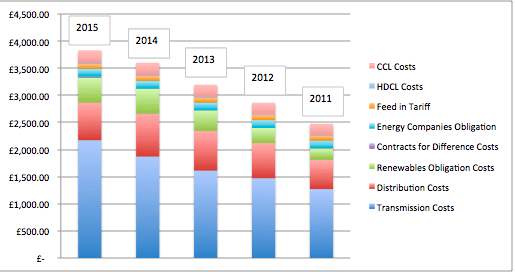

Since 2011 we can track this rise in the chart below:

The rise in ‘third party’ costs is therefore abundantly clear.

Taking a typical business electricity customer, consuming 43,247kWh per year we can see that this cost has grown from an average £2,475 in 2011 to £3,830 today.

That is a rise in third party costs of 55% over the period.

Over the same period the wholesale energy price for Summer 2015 has decreased by 36%.

So the next time you ask yourself:

If the wholesale price is falling why isn’t my energy bill?

You know the answer. Not that you’ll hear the politicians tell you that.

A: The government

For an instant quote or free advice, simply give Business Juice a call on 0800 051 5770. You can even email us at quote@businessjuice.co.uk or use our contact form.