What’s in it?

The price you pay on your bill is made up a number of constituent parts:

The price you pay on your bill is made up a number of constituent parts:

- the raw energy cost (or wholesale cost)

- the cost of transportation (or transmission & distribution)

- losses (or unbilled volumes)

- levies (or environmental and social obligation costs)

- metering costs (or supplier operating costs)

- the supplier’s margin (or profit)

What does it look like?

Once all these costs are factored in, your electricity price will invariably be represented in two elements:

- Unit rate(s)

- A standing charge

As a result the electricity price is levied against both the number of kWh you consume (your unit rate(s)) and the number of days you are ‘on supply’ (your standing charge).

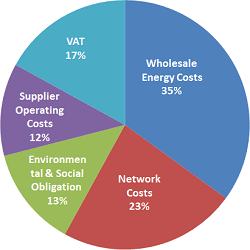

How much does each element contribute?

If we take a notional cost of 10p/kWh for a unit of electricity we can clearly see the contribution of each element. The constituent parts of the electricity unit price can be broken down into 4 key elements:

- Wholesale Costs

- Network Costs

- Environmental & Social Obligation Costs

- Supplier Operating Costs

1. Wholesale Costs

The cost of the energy supplied: 3.50p/kWh or 35% of the overall cost.

a) The raw energy cost – 3.4p/kWh

The largest element of the electricity price is inevitably the cost of the raw commodity, however this might be less than you would expect at 34% of the total price or 3.4p/kWh in a headline energy rate of 10.0p/kWh.

b) Energy Losses in the network – 0.1p/kWh

As electricity travels along the networks from the generator to the customer meter there occurs a natural inefficiency whereby energy is lost along the route. As a result this energy will never be ‘metered’ and paid for unless an assumption of the rate of losses is made and this ‘unbilled volume’ is added to the final electricity price. Losses make up about 1.1% of the price or just over 0.1p/kWh in our example.

c) Imbalance costs – 0.01p/kWh

The electricity industry is ‘settled’ or ‘balanced’ every half an hour, as electricity cannot currently be stored on a mass scale economically supply (generation) must meet demand (usage) instantly. This doesn’t always happen however such occurrences are felt far more often in a commercial sense than in a ‘black-out’ sense. It is this commercial sense that is subsidised by the imbalance charges levied in the energy price. Effectively an insurance payment to compensate for generators and network operators having to balance the system i.e. increase or decrease the volume of energy in the network. This compensatory payment represents around 0.1% of the energy bill or 0.01p/kWh.

2. Network Costs

The cost of transporting the electricity to the meter: 2.29p/kWh or 23% of the total cost.

The second largest element is the cost of transportation of the electricity across both the transmission network and the local distribution network. This is made up of:

a) Distribution costs – 1.7p/kWh

It is the latter, the distribution network that costs the greater part of the transportation charges at 17% or 1.17p/kWh in our headline rate.

b) Transmission costs – 0.5p/kWh

Transmission by contrasts costs 5,2% or 0.5p/kWh. The supplier will pay the relevant regional distribution network for their services; these are now privately owned enterprises often with multiple regions under single ownership. These businesses are required to publish their tariffs so that suppliers can accurately forecast and charge the customer appropriately to cover their costs. The transmission costs are payable to a single entity, National Grid, and the costs are directly related to the length of the network the commodity travels through in order to reach the required entry point into the distribution network.

c) Balancing costs – 0.09p/kWh

The costs associated with balancing the overall electricity system add around 0.09p/kWh to the energy price or 0.9%.

3. Environmental & Social Obligation Costs

The cost of supporting various government initiatives through the energy price: 0.94p/kWh or 9.4% of the price

Government ‘green’ initiatives are becoming an ever more influential part of the electricity price and we soon won’t be able to count the number of different costs on the fingers of one hand.

a) Renewables Obligation – 0.6p/kWh

The Renewables Obligation has the most significant impact on the electricity price, this payment is used to subsidise and reward those generators investing in renewable generation and in total contributes 6.1% to the price or 0.6kWh in our example.

b) Contracts for Difference

RO will be joined by Contracts for Difference (CfDs) from April 2015, ostensibly doing the same thing, these subsidies will overlap for a number of years and increase the burden on the energy price.

c) Electricity Energy Companies Obligation – 0.25p/kWh

The Electricity Energy Companies Obligation or ECO is a scheme levied on suppliers to invest in customer efficiency projects such as subsidised loft insulation.

d) Feed in Tariff – 0.16p/kWh

The Feed In Tariff or FiT is another scheme to encourage renewable energy, this one rewarding small scale generators. FiT adds around 1.6% or nearly 0.16p/kWh to our average unit rate.

e) Higher Distribution Cost Levy – 0.1p/kWh

A different sort of levy, this time to support remote networks and subsidise the otherwise cost prohibitive activity of transporting electricity to those regions. Currently only focussed on the North of Scotland this charge is levied on all customers as part of the electricity price, making up 1.0% or 0.1p/kWh.

f) A Government Funded Rebate -0.18p/kWh

4. Supplier Operating Costs

The cost of actually delivering the supply to you, the customer: 1.24p/kWh or 12.4% of the retail price.

The penultimate contribution to the electricity price is the costs of the supplier in delivering the services to the customer plus their profit. These include the cost of metering, both the provision of the meter itself and the reading and data handling responsibilities.

The supplier appoints a third party metering agency, who like the distribution companies were once part of the wires and retail network but are now under private ownership, sometimes they are part of the distribution network, sometimes independent.

The level of charges for their services vary by meter type and the technology used and the supplier relies on these relationships to source the reads from your meter and to ensure sufficient data is collated to facilitate accurate estimation where an actual reading is not available.

These costs, covering the operational costs of the supply business such as their cost of sales and their profit contributes another 12.4% or 1.2p/kWh to the final electricity price.

This margin, taking our example 10p/kWh price and an average customer consuming 30,000 kWh per would equate to around £372 per customer per year to cover all the supplier costs and any profit on a bill of £3,000 .

Of course any supplier that also owns generation assets has the potential to make additional margin from this element too.

5. VAT and Climate Change Levy

The cost of additional government taxes on the energy price: 2.02p/kWh or 20.2% of the price

Two further government taxes are applicable to business energy costs:

a) VAT

Business electricity is subject to a VAT rate of 20%

b) Climate Change Levy

Climate Change Levy is applicable to every unit used and is currently (2014/15) charged at the p/kWh rate of 0.541p/kWh.

The final tally

Once all the above is taken into consideration we can therefore conclude that the proceeds from the price of energy you pay is split between:

- 35.1% going to the generators

- 29.7% going to the government

- 22.8% going to the networks, and

- 12.4% going to the energy supplier

The full table

| Electricity | Gas | |||

| Wholesale Costs | Wholesale Energy | 33.9% | Wholesale Energy | 40.8% |

| Unbilled Volume (Losses) | 1.1% | Unbilled Volume (Losses) | 1.1% | |

| Reconciliation by Difference | 2.0% | |||

| Demand Forecast Error | 2.0% | |||

| Imbalance Costs | 0.1% | |||

| Network Costs | Transmission Costs | 5.2% | Transmission Costs | 1.7% |

| Distribution Costs | 16.8% | Distribution Costs | 17.0% | |

| Balancing Costs | 0.9% | |||

| Environmental & Social Obligation Costs | Renewables Obligation | 6.1% | ||

| Contracts for Differences | ||||

| Energy Companies Obligation | 2.5% | Energy Companies Obligation | 2.0% | |

| Feed in Tariff | 1.6% | |||

| Higher Distribution Cost Levy | 1.0% | Higher Distribution Cost Levy | 0.8% | |

| Govt. Funded Rebate | -1.8% | |||

| Supplier Operating Costs incl. Metering | 11.8% | 11.8% | ||

| Depreciation & Amortisation | 0.6% | 0.5% | ||

| VAT | 16.7% | 16.7% | ||

| Climate Change Levy | 3.7% | 3.7% | ||

| 100.0% | 100.0% |

And there you have it, how the electricity price is made. For more information, or if you simply want us to get the best deal for your business, simply call us on 0800 051 5770, we’d love to hear from you.